Treasury Managers

Decentralized Autonomous Organisations (DAOs) are one of the pillars of the blockchain revolution. They allow decentralized and transparent management of blockchain projects while maintaining flexibility and adaptability. One of the most critical roles of DAOs is to manage the treasury raised by the sale of governance tokens.

The treasury is supposed to be used to finance new projects and maintain a stable value for the governance tokens. To maintain price stability, DAOs will often hire experienced market makers to trade their governance tokens on centralised and decentralized exchanges to prevent too much volatility. This presents a unique dilemma for the industry. Effective market making requires that the market should not be able to anticipate the market maker's actions. At the same time, we need to maintain a transparent system. While treasuries can deploy assets on auto-managed vaults, these vaults do not provide the necessary flexibility and manoeuvrability for efficient market making, which must be driven by an understanding of market psychology and adapted to dynamic liquidity conditions.

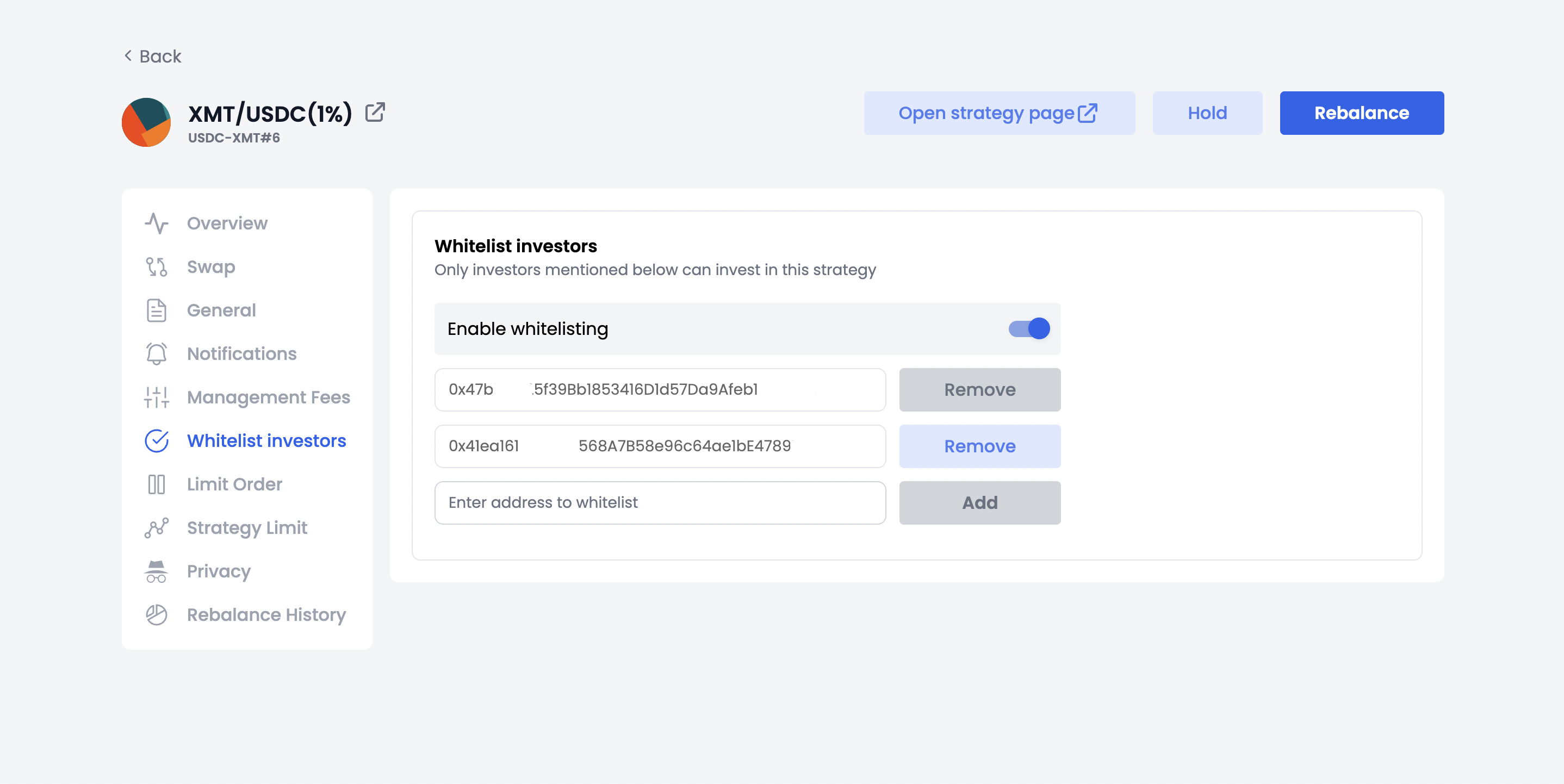

In comes DefiEdge. Our strategies are designed for foresightful strategy managers who can anticipate price movements and deploy liquidity for profit. Our contracts allow these strategy managers to attract capital on a decentralized, non-custodial, and permissionless platform. Strategy managers also have the authority to restrict capital inflows by whitelisting select addresses. Thereby, strategies on our platform can be used as a transparent vault to support governance tokens or earn yield on idle assets in a DAO’s treasury.

|

|---|

DefiEdge is designed as a platform where anyone can anonymously and without permissioning deploy strategies or deposit liquidity in these assets. Still, it also supports authentication through Twitter for managers who wish to leverage their credibilities. When DAOs hire well-known professional market makers to manage their treasury, it instils confidence amongst token holders and traders around the token valuation. Treasuries can create strategies corresponding to UnswapV3 pools where their tokens are traded. These strategies will have well-known market makers as their managers. Our 1Inch integration gives strategy managers access to liquidity throughout the network along with the ability to LP into UniswapV3 pools. DefiEdge is a one-stop solution for market making on the whole network (we support all chains where UnswapV3 is present) with transparent yet nimble trading strategies.